Table of Contents

[ad_1]

The online food delivery industry has seen exponential growth over the decades. With a worldwide revenue figure amounting to $122.740 billion, the food industry has a growth rate of 7.5% with almost 1.1 billion users across the globe. It is expected to grow with a Compound Annual Growth Rate of 32% (approximately) by 2021. Such staggering facts reveal how big the industry is growing to the ever-increasing popularity of ordering food online. When we say ordering food from online applications, there is one name that a major chunk of the world reiterates and that’s GrubHub. The online food delivery giant is doing extremely great in terms of service and revenue generation. In 2018, there were approximately 18 million users of GrubHub, with over 115,000 restaurants spread across more than 2,200 cities worldwide. Not only that, the company has partnered with more than 140,000 takeout restaurants and diners.

The GrubHub revenue model is systematic, efficient and works exceptionally well for the company. But before treading into what that is, and how it is reaping all the profits, let us have an understanding of GrubHub, how the app functions, and how it operates.

What is GrubHub

America’s leading food delivery company GrubHub was formed in 2004 by Matt Maloney and Mike Evans. It allows you to order food via your smartphone from any place within your city. It operates in over 2,700 cities in the US and UK. In 2013, it merged with Seamless, another popular online food delivery company, which gave enormous mileage to the company.

GrubHub is listed on the New York Stock Exchange (NYSE) with its ticker symbol ‘GRUB’.

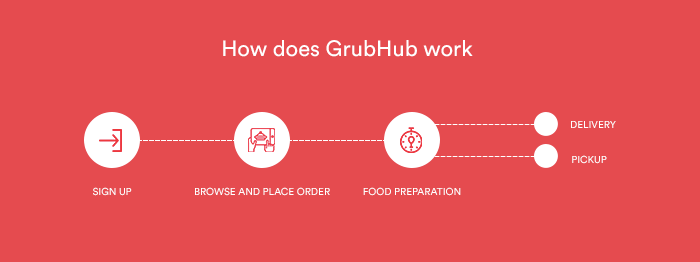

How does GrubHub work

The GrubHub app is quite easy to use. Whether it’s delivery of food or a pickup, you can learn to use its maiden use. If you’re familiar with ordering food online via other applications, using this should be a cakewalk for you. Here’s explaining it in 4 simple steps with which you get to know how GrubHub makes money.

1. Sign UP

The first thing is to create an account. You can create your profile with the necessary details and add your current location.

2. Browse and Place Order

You can browse through the options nearby, explore the restaurant options, go through the menu and place the order of your choice.

3. Food Preparation

Once you’ve placed your order, you will be given an estimation of how much time it will take for your food to be prepared and the minutes left for delivery.

4. (a) Delivery

Your food package(s) will be out for delivery and will be delivered by the assigned executive.

(b) Pickup

Instead of waiting for your food to be delivered you can go directly and pick it up from the restaurant.

With GrubHubs, multiple locations can be saved for your convenience.

GrubHub’s list of brands are some of the most renowned names in the world. They are as follows:

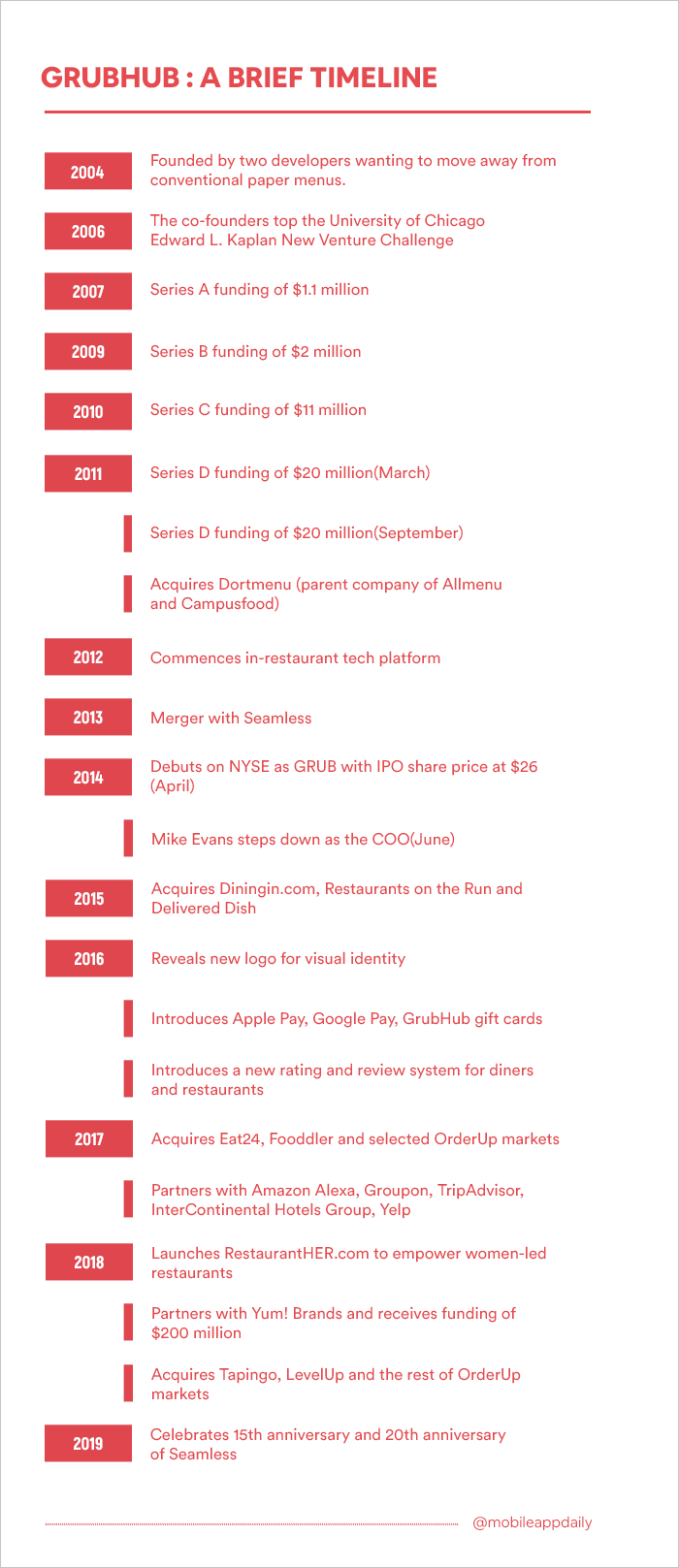

GrubHub timeline

Although GrubHub was founded in 2004, things really started to gain momentum 2006 onwards when Evans and Maloney bagged the top spot at the University of Chicago Booth School of Business’ Edward L. Kaplan New Venture Challenge. They presented their business plan for GrubHub. Afterwards, there wasn’t any looking back. The beam of hope arrived when they received their maiden funding of $1.1 million from Amicus Capital and Origin Ventures in Series A funding. They procured the amount to expand their sales into New York and San Francisco. Since then, GrubHub funding has had eight rounds in total (as of now), and the brand made 12 acquisitions.

The following is a timeline highlighting major events and milestones in GrubHub’s journey.

The Value Proposition of GrubHub

A highly integral aspect of the GrubHub business plan is the value proposition. The company has two types of partners viz. Restaurants and Diners. The proposition explains how it creates value for its partners as well as customers. It helps the brand’s clients and customers to identify with the brand. It’s a two-way communication process where the brand promises that value (advantages) will be delivered with the expectation that the same value will be experienced by the customer. When we talk about GrubHub, it’s better to understand the differences in the value proposition for restaurants and diners.

Value Proposition for restaurants

At full menu prices, GrubHub for restaurants, generates takeout orders at a higher margin. The takeout is an opportunity for restaurants to grow their businesses without worrying about seating capacities. A study by Morgan Stanley reveals that digital food delivery services will make up a total of 11% of the restaurant sales by 2022.

But the takeout process is extravagant and comes with its share of hassles. That’s why GrubHub offers services where there’s no risk involved and also opportunities for the restaurants to enhance their operational scope. There’s actually more to it as with the app, restaurants and diners can connect with each other, and the latter can find the best matches and track orders with minimal efforts.

The following propositions are the key incentives for restaurants:

- Restaurants can reach out to more and more customers for an extended customer base.

- They enjoy an efficient and trackable high-return solution which has extremely low risks involved.

- With the app, they can monitor and supervise deliveries. The GrubHub channel, a software, helps them do that.

- No upfront charges or subscription fees are levied on the restaurants.

- GrubHub provides its own delivery executives, so the restaurants don’t have to worry about it.

Value proposition for diners

Diners are basically people. As a user, you can either place your order to be delivered at your doorstep or you can pick it up from a nearby restaurant instead of waiting for it to be delivered. It makes the takeout process faster by removing unnecessary complications.

The following are some of the important values given out to diners by GrubHub.

- It connects diners to a wide assortment of restaurants from where they can browse through the menus and deals.

- It’s open on all 7 days and 24 hours providing round the clock services.

- Diners can track their orders and the status of their pickup anytime.

- It has powerful AI and ML features which remember what you ordered previously and can repeat it countless times.

- Diners living near the eatery can simply pick up the food instead of waiting for an agent to deliver.

The GrubHub business model: How does GrubHub make money

GrubHub has a very compelling business model. It lets you know how does GrubHub make money. While starting out Mike and Matt wanted to create something where people don’t have to go to restaurants, limit their choices to the menu and wait idly at their tables until the food is served.

GrubHub, which mostly earns through its app version, has successfully connected customers to restaurants to make buying food digitally a more convenient means of marketing. It uses more than 60 technologies to operate. Speaking of the app, it has a cohesive UI and UX design that guarantees the user to solve their pain points and reach the intended goal smoothly. In its fifteen years in the online food delivery market, it has risen to be the key changemaker of the service industry.

The GrubHub Marketing Strategy: What to Learn From It

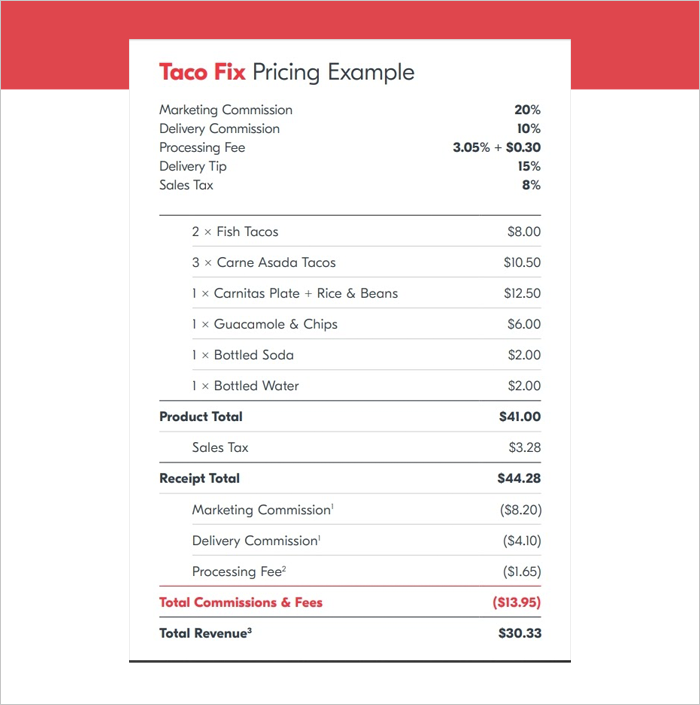

GrubHub charges restaurants a commission per order, which is based on a percentage. It also earns revenue when any customer places an order with the app. In the case of restaurants, they get the chance to opt for a commission slab which should either be at par with the base charge or above it. Higher the commission, better the connectivity to customers/diners.

Speaking of the GrubHub delivery fee, it charges diners additional charges on the food ordered. Even restaurants have to pay delivery charges. The next part reveals what does GrubHub charge both restaurants and diners.

GrubHub Commission Fees

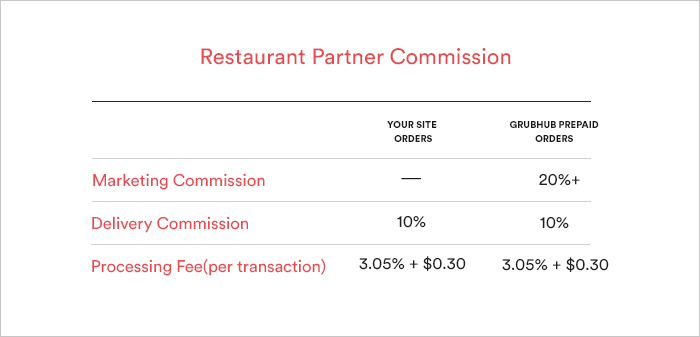

GrubHub charges 10% as the base commission rate on every order. It also charges a processing fee of 3.05% with an additional sum of $0.30. For a restaurant to have a better position in the listing for diners, it needs to pay a further commission of 20% or more depending on the exposure one yearns for.

Types of GrubHub Commission Fee

There are 5 types of fees that are pertinent to the GrubHub model of business.

| Fee Type | Application |

|---|---|

| Prepaid Order Commission Rate | When you place an order via the web or app, this fee is applicable. Also applies to your delivery charges |

| Delivery Commission Rate | Applied to the your item charges if it is being delivered by GrubHub |

| Phone Order Commission Rate | If you order from the routing mobile number listed on GrubHub, this fee is chargeable on your item |

| Order Processing Fee | Chargeable on each prepaid order. (3.05%+$0.30) |

| Pay Me Now Fee | If your balance is solicited and released on the same date, a $1 charge per transaction is applied. |

Growth Strategy of GrubHub

The company growth can be an example for startups who want to plod into the same domain or any domain if speaking at a macro level. To get more diners and restaurants, it has a coherent growth strategy which testifies to its motive of earning more and growing as a brand.

Enhancing the takeout marketplace

GrubHub aims to make as many chains of restaurants at the national, regional and independent levels that are in the existing and newer business areas to grow at an impressive rate. The ‘growth’ in this context means enabling opportunities to such eateries by generating more takeout orders and offering delivery services.

For diners, it wants to constantly increase its customer base both by traditional and modern marketing methods and also by word-of-mouth advertising. More diners will result in higher-order frequencies.

Leverage Platforms for increased orders

GrubHub will continue investing in numerous mobile and website products including its delivery network, strategise better and modern ways to aggravate the data count and bring that into fruition.

“We sell growth, we sell orders. I don’t care if that’s a pickup order, a delivery order, a self-delivery order or a cater (sic) order.“

Matt Maloney on CNBC (2019)

class=”twitter-tweet”>

Meeting the expectations of the user and proving the best of customer care services

One half of the GrubHub business model is to give its customers nothing but the best services. And customers aren’t restricted only to diners who use the app, but to restaurants as well. The company foresees meeting and exceeding the expectations of its clients and customers.

Getting more acquisitions, fundings and partners

GrubHub is the parent of 12 subsidiaries and has more than 140,000 partners, which is a huge achievement within a span of 15 years. It also underwent eight rounds of funding, with the latest being Yum! Brands in 2018 where it raked $200 million. The company wants to explore further in the existing markets and expand in newer markets too via continuous acquisitions and strategic partnerships and promoting the takeout process.

Measuring the success of GrubHub

The American food industry is ever increasing. If we talk about the biggest online food delivery apps alone, DoorDash took the biggest share of the cake with 37% meal delivery sales in November 2019. Next came GrubHub with a 30% share way ahead than UberEats which was complacent at third with a 20% share.

According to Technomic, the trinity collectively did a $10.2 billion business in 2018.

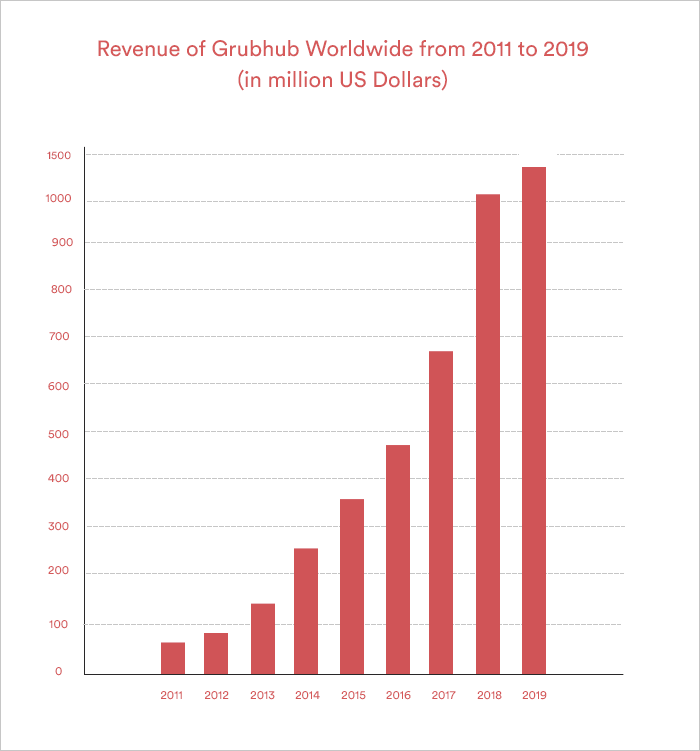

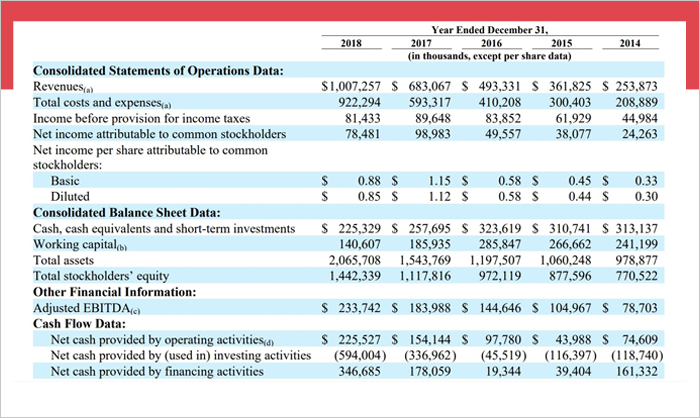

When speaking solely about the company’s success, the increase has been steady. From 2017 to 2018, it had a 47% surge in the annual revenue growth. 2018 was also the year when the company touched the billion-dollar mark in its annual sales. It’s a mammoth jump of $324 million in a single calendar year.

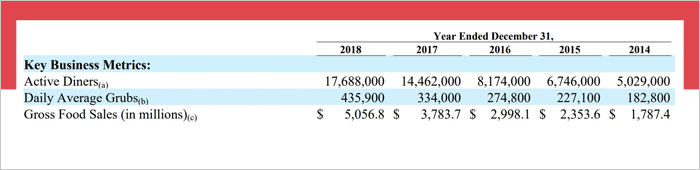

Where GrubHub is seeing significant improvement

- Active Diners– An active diner is a single user account from which an order is placed using GrubHub’s services. It is only considered active if the order has been placed within a span of twelve months. The Active Diner metrics are mandatory because the number of active diners determines the size of the company’s target diner community. It’s also the primary revenue determinant. Users with multiple Active Diner accounts can be calculated more than once at any given point of time.

- Daily Average Grubs– Daily Average Grubs is calculated as the total order count on GrubHub divided by the number of days for a given period. The total count of orders processed by GrubHub is an important metric in the GrubHub pay model to compute annual revenue for the food delivery company and along with the Active Diner metrics, it helps to extrapolate diner activity on the platform.

- Gross Food Sales– The total numerical value of food and beverages, taxes, gratuities (prepaid) and delivery fees paid by diners processed by GrubHub determine the Gross Food Sales. It’s an important growth metric for the company because it calculates the total volume of food sales. Since GrubHub acts as a merchant/intermediary, in this case, the revenues that it earns through commissions from each transaction are acknowledged on a net basis. Net calculations are a percentage of total Gross Food Sales.

Comparison of each GrubHub metric (2017 vs. 2018):

- Active Diners: Active Diners count in 2018 was 17.68 million which was a 22% increase from 2017’s figure of 14.46 million

- Daily Average Grubs (DAG): DAG count in 2018 was 435,900 in comparison to 334,000 which was an increment of 31%

- Gross Food Sales: 2018’s Gross Food Sales figure stood at $5,056.8 million whereas, for 2017, the figure stood at $3,783.7 million which was a hike of 26%

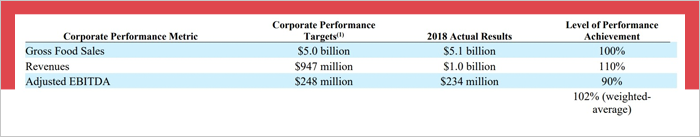

Comparison of GrubHub’s estimated targets for 2018 and the actual performance in each metric.

In Gross Food Sales, it hit the bullseye with 100% achievement in pre-established targets. Revenue generation crossed expectations with a 110% achievement. In Adjusted Earnings Before Interest Tax Depreciation And Amortization (EBITDA), it was short by 10% of the expected outcome.

How the GrubHub Delivery App Makes It Convenient for Restaurants and Diners

Success didn’t knock GrubHub’s doorstep; the company earned it. And its services to all its partners are proof of the user-friendly amenities that it provides. The company has a fantastic web and app business model that helps it to augment itself as an MNC. With its app now a key platform for income and also being listed on the NYSE, the company is making an annual improvement in revenue generation while also investing aggressively in areas that will help it to become better. As part of the GrubHub model of business, it constantly focuses on bringing out new offers that will enhance the experience of all its partners.

- A diner gets both the Delivery and Pickup options.

- GrubHub offers deals and discount coupons regularly.

- The ratings help restaurants with a better ranking to appear higher in the lists.

- Once the diner sets the location and selects a restaurant, he/she gets to know the delivery charge(s) for GrubHub’s services.

- To make the mobile app business model unique, GrubHub introduced a feature where users get to know the normal average amount of food they need to consume at an eatery.

The following are the advantages that restaurants and diners have enjoyed separately.

Merits enjoyed by Restaurants

- Increased number of orders at full menu prices

- Higher margin takeout with lower risks

- Gaining network reach and visibility among diners

- Management of a larger amount of takeout orders with 100% operational efficiency

- Provision of actionable insights on the total order count

- Optimized delivery footprints, menus, pricing and online profile

- Nullified the complexity of staffing by offering delivery services

Merits enjoyed by Diners

- Discovery of more eateries and access to full menus across 2000 cities in the US alone

- Ease of convenience in placing an order with a connected device

- Full transparency with ‘Direct line’ to the kitchen without the hassle of order-taking calls

- Critical customer service which is missing from other takeout providers

Ownership of GrubHub

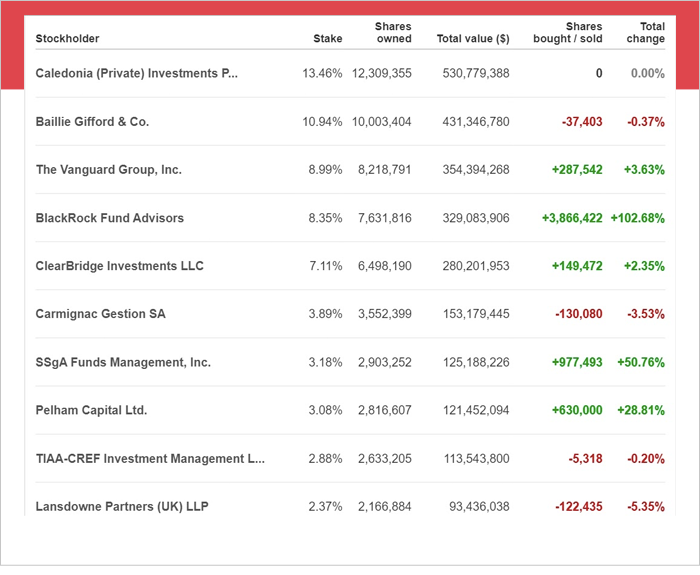

When GrubHub and Seamless formed a coalition in 2013, Seamless represented 58% of the equity and GrubHub 42%. There are many stakeholders of GrubHub Seamless who enjoy some amount of share in the company.

In the following image, you will find the names of the Top 10 stockholders of GrubHub.

Present and Future challenges that GrubHub will face

There are organizational challenges that a business has to face. Whether small or big, one has to overcome them with meticulous planning and smart implementation. GrubHub as a unit also faces many challenges which stand in front of them. Whether it’s the creation of new GrubHub marketing plans or recreating the app revenue model, you can get a fair idea of the key issues it has to meet from the following list.

- As part of the company’s long-term growth strategy, it is working on the expansion of the takeout marketplace for restaurants and diners with a more cost-effective approach.

- Popularising the brand image and maintaining the brand reputation.

- More investment for a more effective utilization of the GrubHub food delivery network.

- Maintain the profitability level and have enormous growth every year

- The potential to understand the advantages of the acquired businesses relies on the efficient integration of the operations of the acquired businesses with those of the company.

- Staying up to date with the changing technological changes and using the best of technology in the online takeout marketplace.

- Apart from the traditional offline takeout process, it faces threats from contemporaries. like DoorDash and UberEats who are gaining traction on GrubHub. These GrubHub competitors could have better resources or other factors that could be beneficial and hamper GrubHub’s profitability factor.

A quick revisit

- GrubHub is one of the biggest names in the global food delivery markets and has revolutionised the online takeout marketplace.

- It has two types of partners- Restaurants (from where you select the item for your order) and Diners (the user who is ordering food).

- It has more than 140,000 partners and receives more than 457,300 orders every day with 21.2 million active users.

- It believes in providing several value propositions to its restaurants and diners.

- The company charges 10% on every order as the principle commission fee. An additional process fee of 3.05%+$0.30.

- If a restaurant pays an extra commission of 20%, then GrubHubs ranks it higher in its listings.

- There has been significant success with the following metrics – Average Diners, Daily Average Grubs, Gross Food Sales.

- It has undergone eight rounds of funding and in 2014 debuted on the NYSE with the ticker ‘GRUB’.

- GrubHub is placed second (behind DoorDash) with 30% of meal delivery sales during November 2019.

- At the end of 2018, it had generated $5.1 billion in Gross food Sales and $1 billion in revenue for the first time.

- It faces both present and future challenges which if not tackled properly will hamper the company’s success.

Aparna is a growth specialist with handsful knowledge in business development. She values marketing as key a driver for sales, keeping up with the latest in the Mobile App industry. Her getting things done attitude makes her a magnet for the trickiest of tasks. In free times, which are few and far between, you can catch up with her at a game of Fussball.

[ad_2]