Table of Contents

When selecting a crypto exchange, there are several important factors to consider. These factors include protection from fraudsters, legitimacy, support for new coins, and fees. These factors will help you decide which crypto exchange is suitable for you.

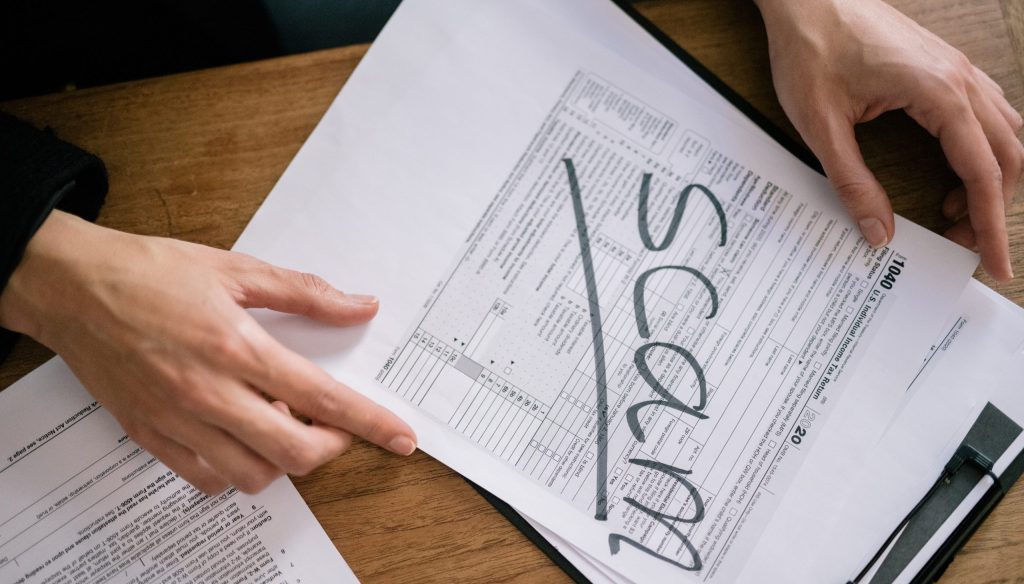

Protection from fraudsters

It is essential to choose a crypto exchange that offers proper protection against fraudsters. Fraudsters target businesses because they store digital cash and are the easiest way to access it. However, compared to banks and loan providers, exchanges are entirely decentralized, which means they don’t want to take on the responsibility of preventing fraudulent activities. Choose a cryptocurrency OKX exchange that offers secure logins to protect your account from fraudsters.

By enabling exchange security teams to deanonymize cybercriminals, they can protect customers from fraudulent activities and prevent account takeovers. The best businesses also use advanced technology to ensure that customer logins are not stolen.

Legitimacy

When looking for a cryptocurrency exchange, ensure it has a good reputation and is safe to use. Not all businesses are legitimate, and there are many scams in the industry. Many exchanges use the same design as the accurate site and different domain names to deceive customers. Additionally, new businesses often have a weak security base and need more user-friendly interfaces, which can lead to security issues. Therefore, checking reviews online to verify their legitimacy and safety is crucial.

Thankfully, there are several good crypto exchange reviews online. To check if a crypto exchange is legitimate, ensure it is registered with the proper authorities and financial crime security units. Honest discussions also provide adequate support and follow appropriate security measures. You should also see whether the exchange offers multiple payment methods.

Fee-free transactions

Whenever you exchange cryptocurrency, you should ask yourself whether the crypto exchange you use charges fees. In general, fees are a standard part of cryptocurrency exchanges and often represent a significant portion of the exchange’s revenue. Transaction fees may include network fees, trading fees, and other costs related to transferring money or making deposits. Avoid these fees by reducing your trading activity or switching to a cheaper platform. You can also take advantage of promotional periods.

Cryptocurrency exchanges may charge fees for transactions, but they are not always mandatory. Some cryptocurrency exchanges charge fees based on the amount of cryptocurrency exchanged. These exchanges also charge fees for listing ICOs. These fees are intended to cover the cost of maintaining a blockchain network and incentivize companies and individuals to provide transaction validation services.

Regulations in the United States

It’s essential to consider the regulations of the US government when choosing a crypto exchange. The United States Securities and Exchange Commission (SEC) regulates digital assets. As such, a cryptocurrency exchange is considered a broker and must adhere to AML/CFT reporting requirements. Additionally, the US Office of Foreign Assets Control (OFAC) has issued guidelines regulating virtual currency.

These guidelines establish standards for sanctions screening and best practices for dealing with sanctions-related violations. However, most states still need to adopt regulations that will apply to virtual currency operators.